Tax Advantages: Maximizing Tax Benefits: Choosing Between Capital And …

페이지 정보

작성자 Cleta 댓글 0건 조회 44회 작성일 24-12-27 21:47본문

From a CFO's standpoint, capital leases may be favorable for companies trying to invest in long-time period belongings without quick money outlays, whereas operating leases may very well be advantageous for companies seeking to keep up liquidity and adaptability. Tax advisors, then again, may advocate for operating leases because of the potential for instant tax deductions and off-balance-sheet financing. 1. Depreciation Schedules: Capital leases allow corporations to depreciate the leased asset, potentially leading to a lower taxable income. Accurate and detailed records allow businesses to assert the maximum allowable deductions, minimizing taxable revenue. Additionally, donation strategies can present substantial tax benefits. Charitable contributions, for example, may be claimed as deductions, reducing taxable revenue. Companies can even profit from credits, comparable to research and growth credits, work opportunity credits, and renewable power credit, which can directly scale back tax liabilities.

Therefore, the money balance would have been lowered on the time of the acquisition of the asset. Another necessary side of depreciation is that it is an estimate based on the historic value of the asset (not the alternative value), its expected useful life, and オペレーティングリース 節税スキーム its probable salvage worth on the time of disposal. There is a standard misconception that depreciation is a method of expensing a capitalized asset over some time. What are the present tax guidelines on inheriting a pension pot? If the owner was 75 or over upon death, irrespective of whether or not the fund is otherwise crystallised or not, beneficiaries are topic to income tax at their marginal rate on something they obtain. However, this tax cost may be managed by the beneficiaries drawing it out as a pension or annuity over time.

This is an important consideration when taking yr-finish tax deductions and when a company is being sold. Depreciation expense is reported on the earnings statement similar to another normal enterprise expense. Accumulated depreciation is a running whole of depreciation expense that is reported on the balance sheet. Both depreciation and accumulated depreciation relate to the "sporting out" of an organization's assets. Depreciation expense is the quantity that an organization's assets are depreciated for a single period such as a quarter or the 12 months. Accumulated depreciation is the full amount of put on thus far.

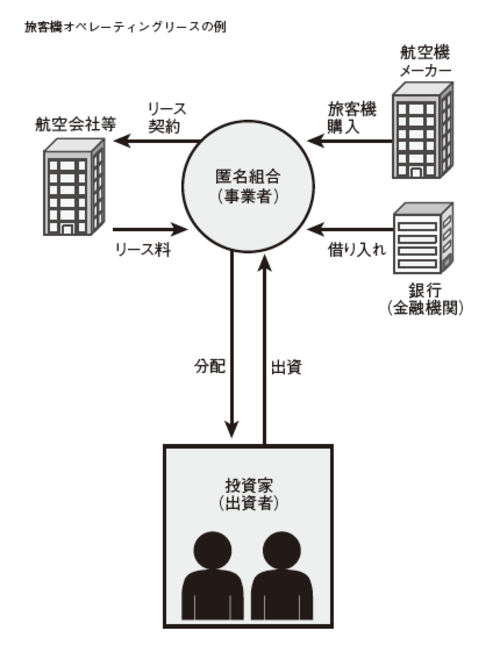

A business can anticipate a big impact on its income if it does not account for the depreciation of its assets. Not accounting for the depreciation of belongings can have a big impression on the income of a enterprise. Declining stability: Bigger depreciation bills are recorded during the earlier years of an asset’s life, while smaller bills are accounted for in its later years. However, at its most fundamental degree, an working lease is typically a ‘dry’ lease, that means the lessee features management of the aircraft for a defined time frame. Inside such an arrangement, the lessee doesn't personal the aircraft, which stays the property of the lessor and is handed again at the tip of the lease.

- 이전글If It is a Medical Emergency 24.12.27

- 다음글Python Variables (With Examples) 24.12.27

댓글목록

등록된 댓글이 없습니다.